Make the most of your DEWS investment

The DEWS Plan puts you in control of your end of service benefit pot.

From choosing the right investment strategy to switching options, manage your investment the way you want to.

If you do not understand the information included on this website or if you require financial advice, you should consult an authorized personal financial advisor.*

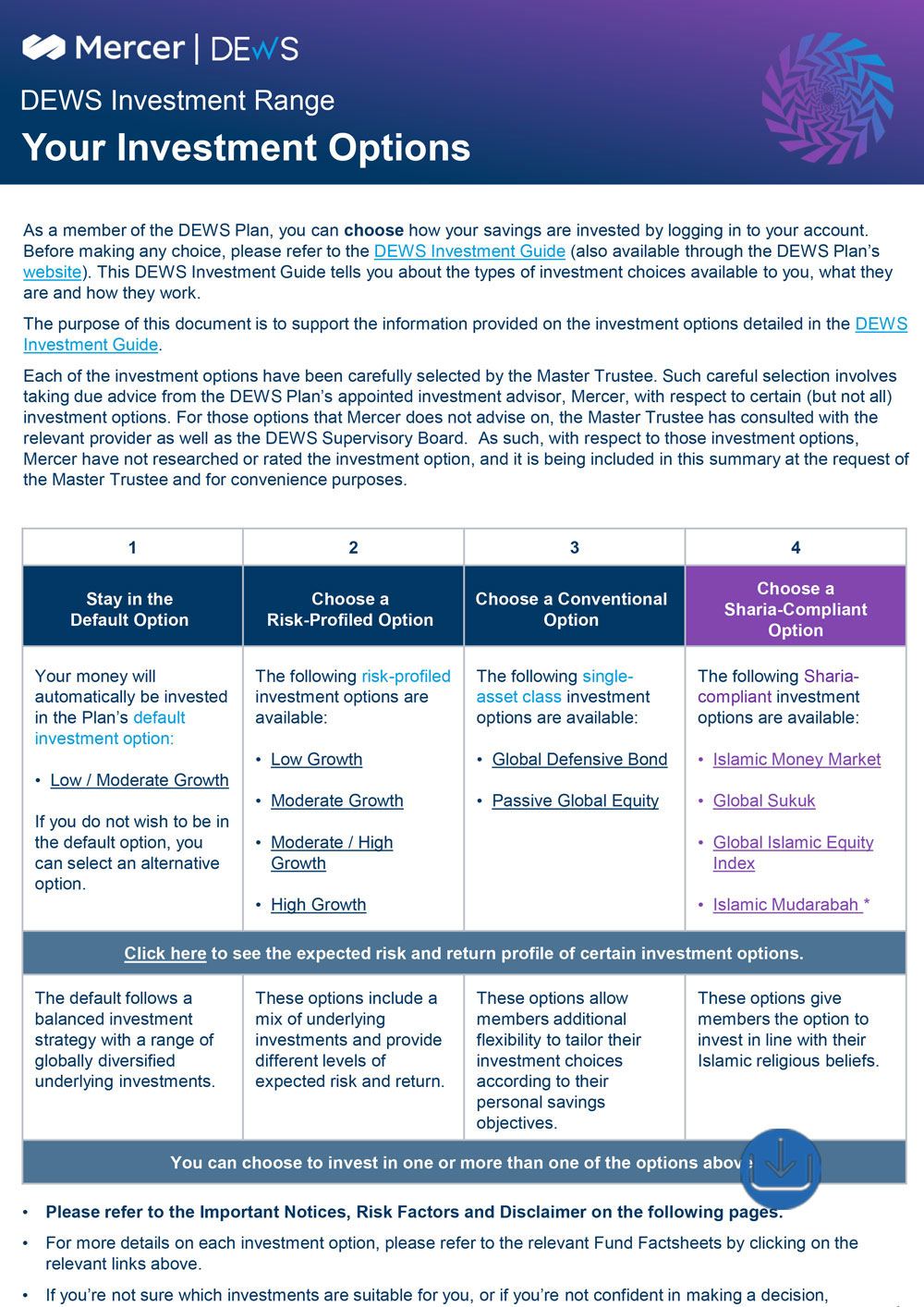

Know your DEWS investment options

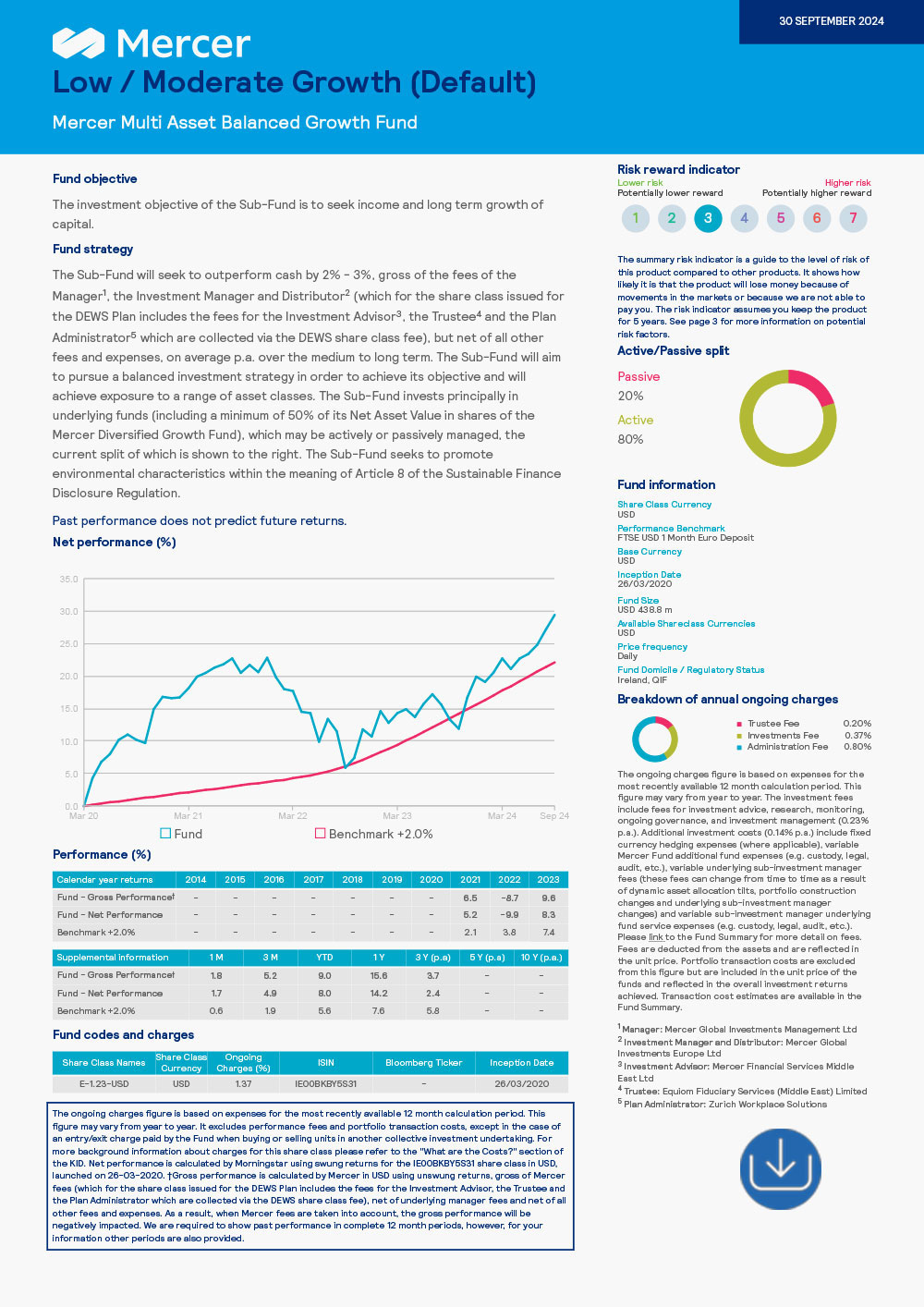

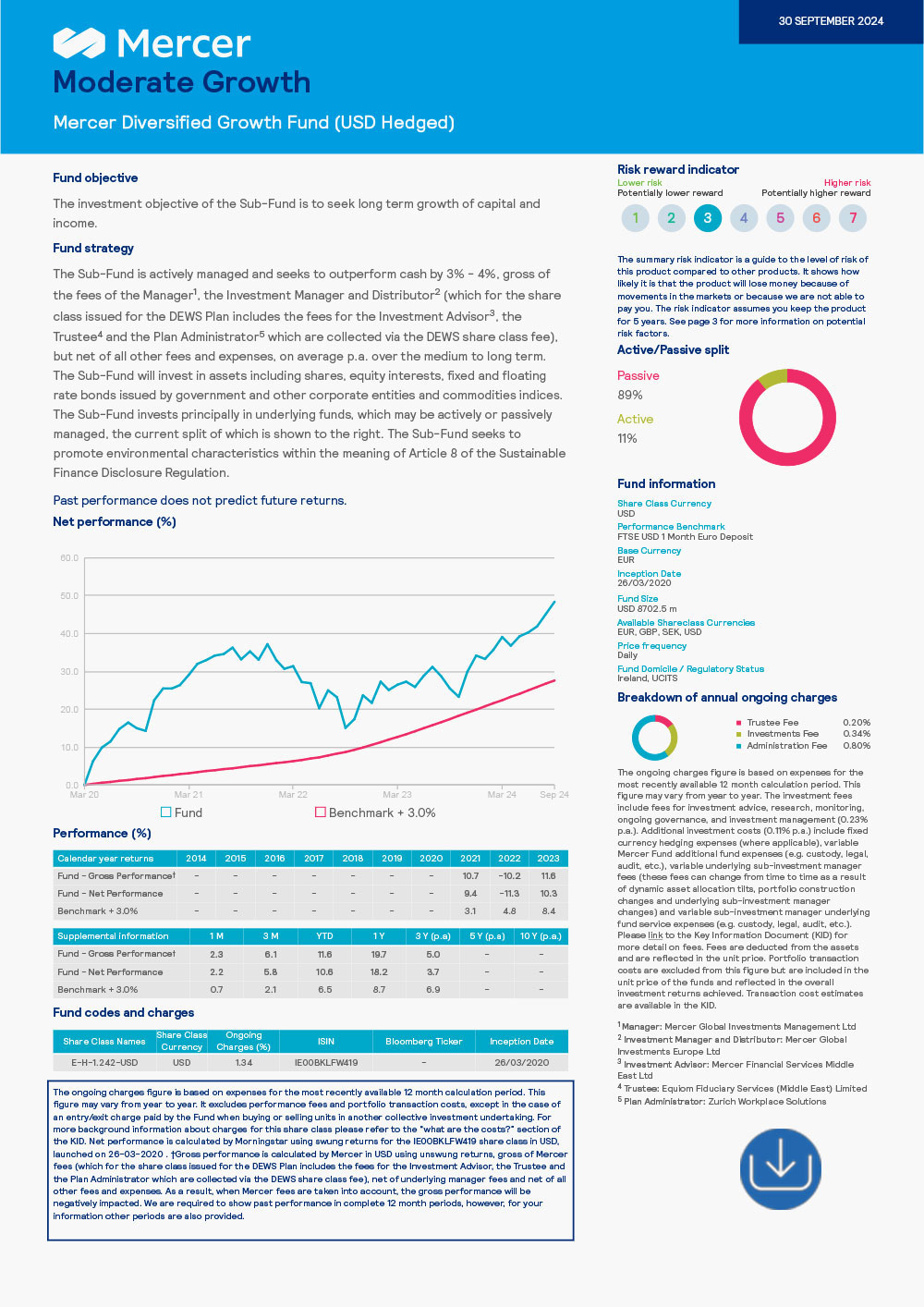

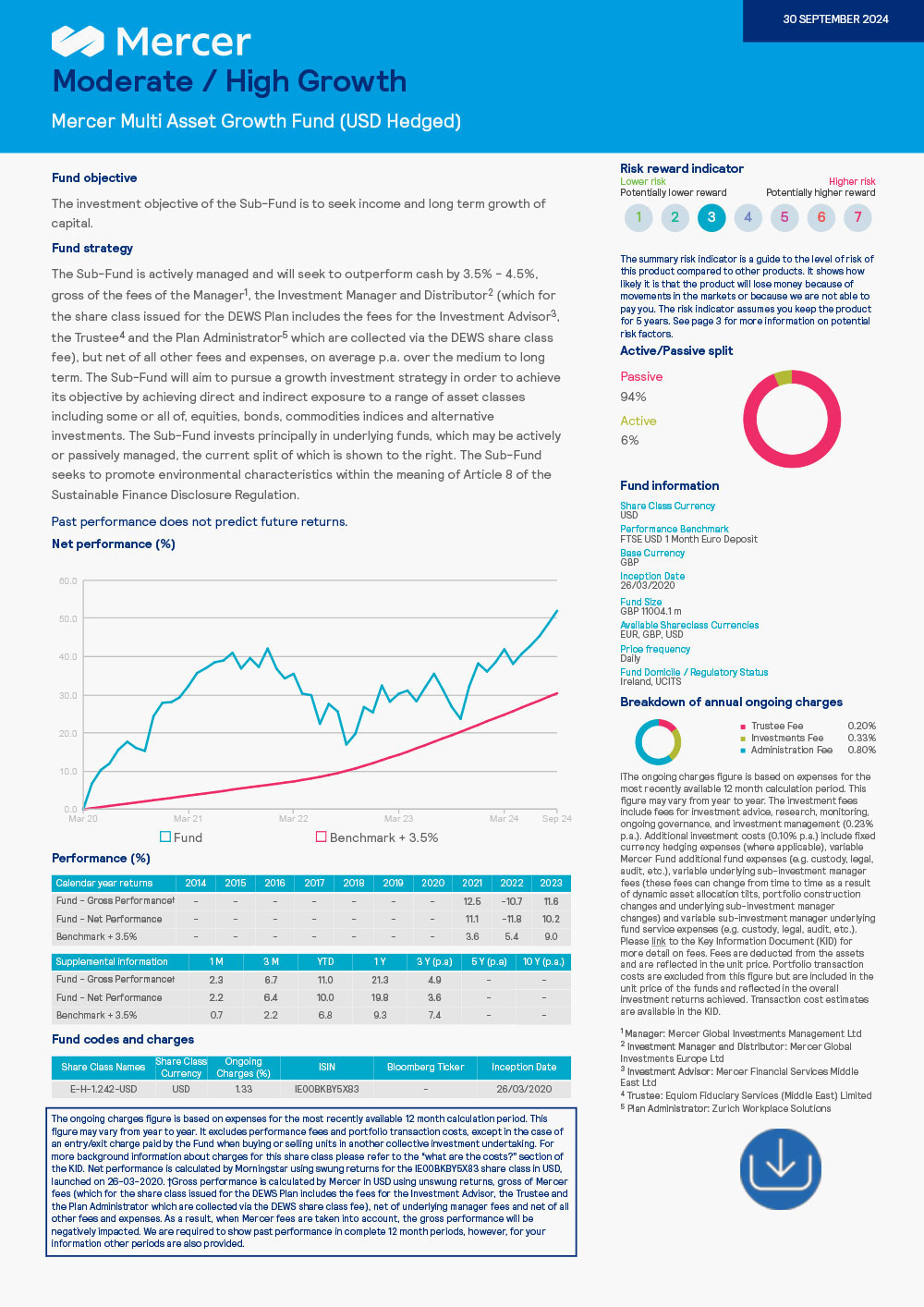

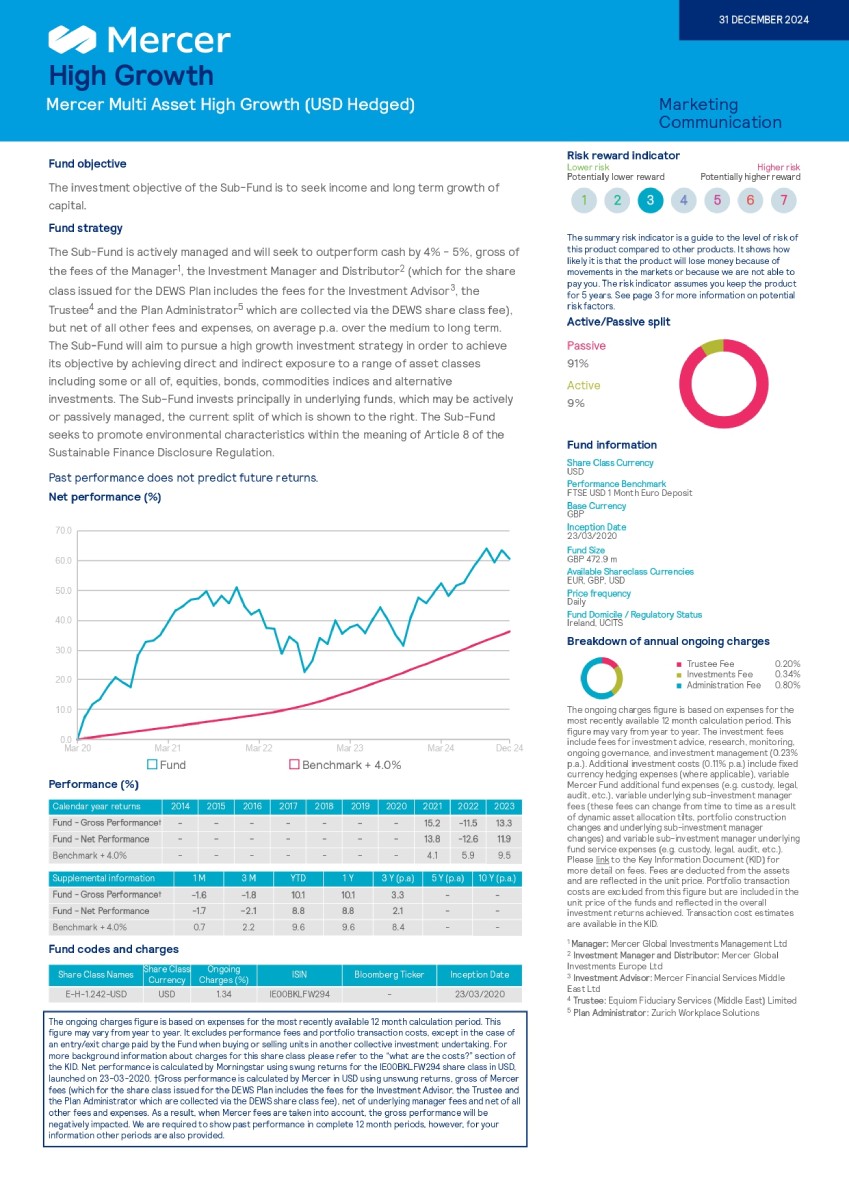

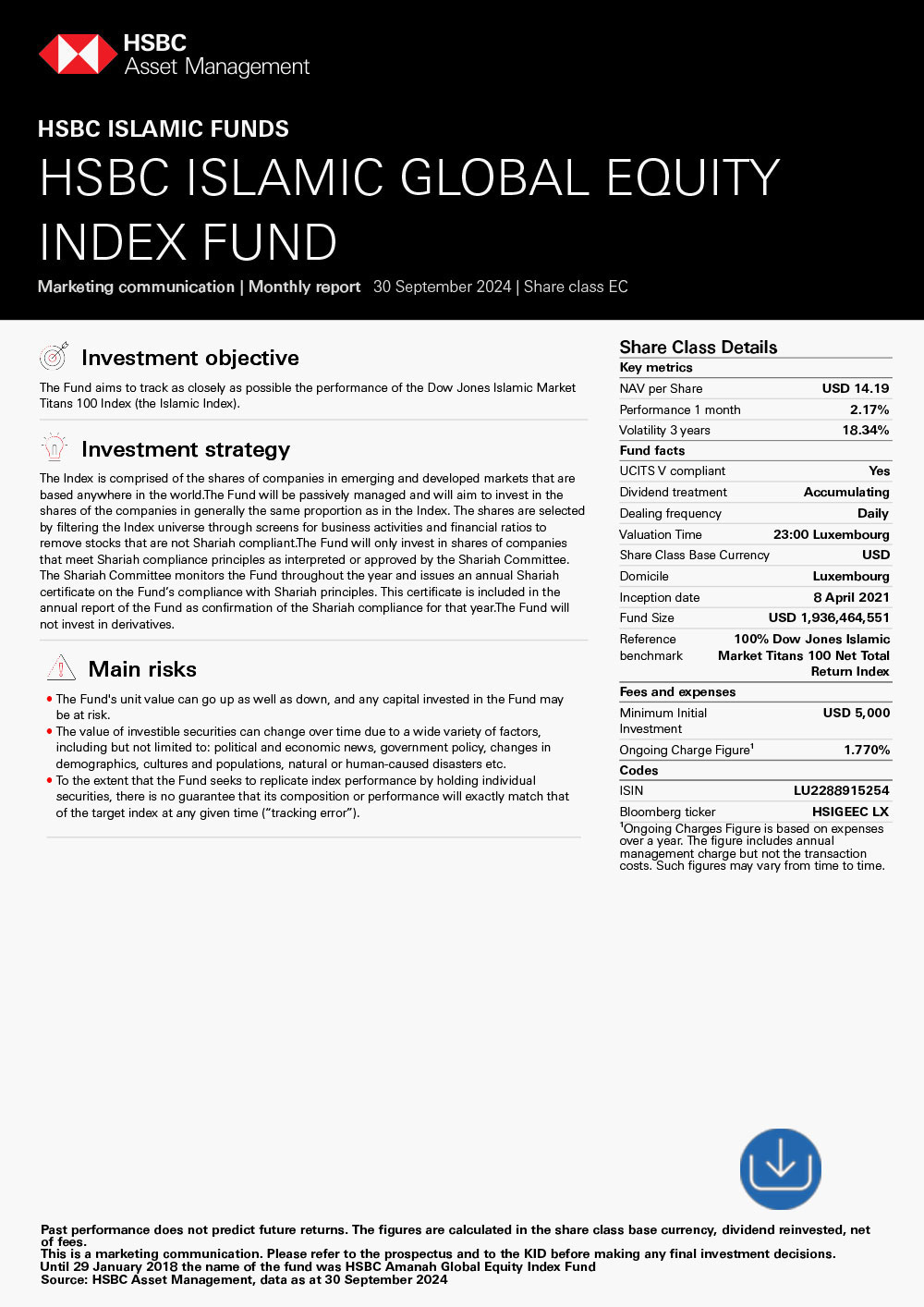

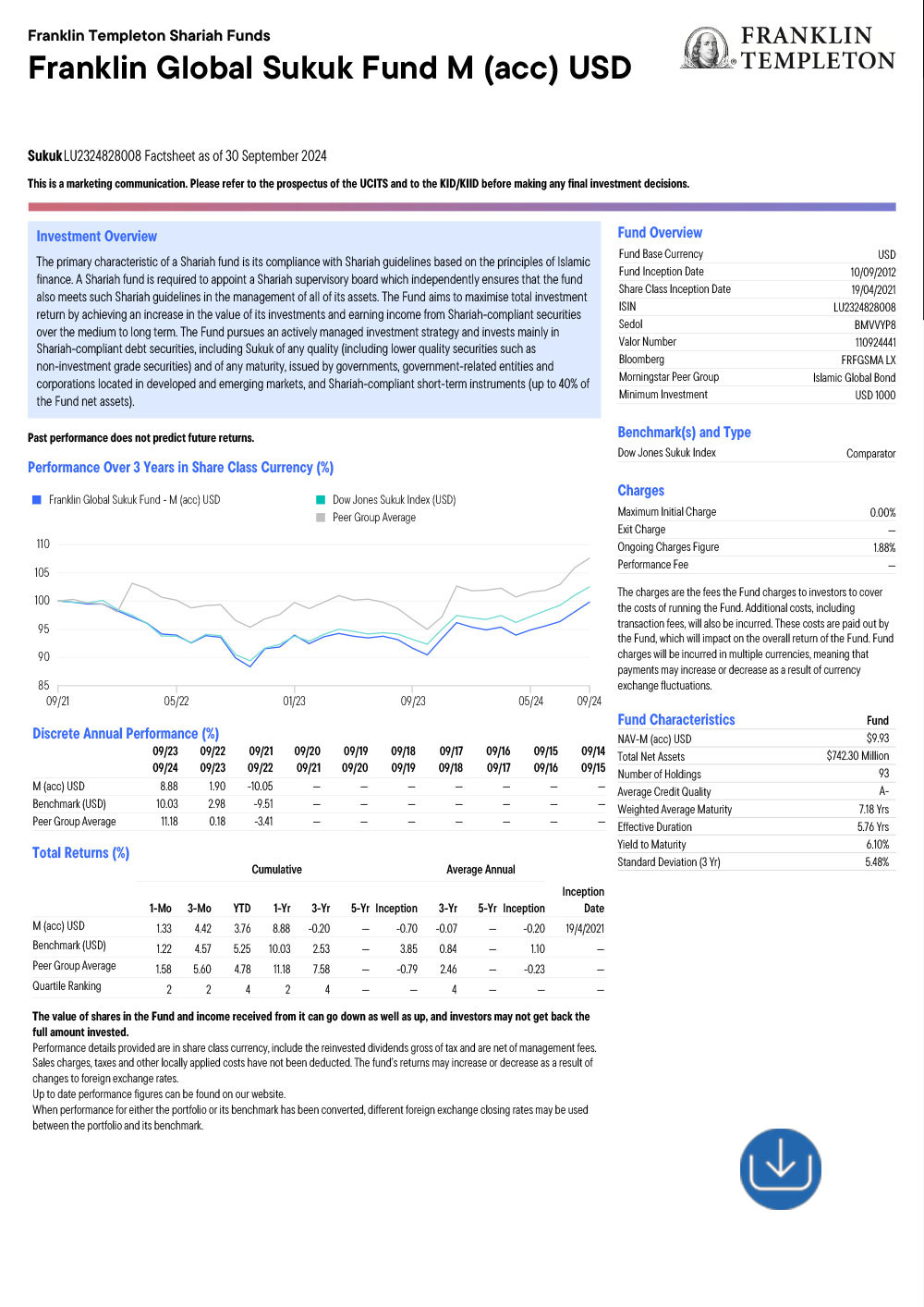

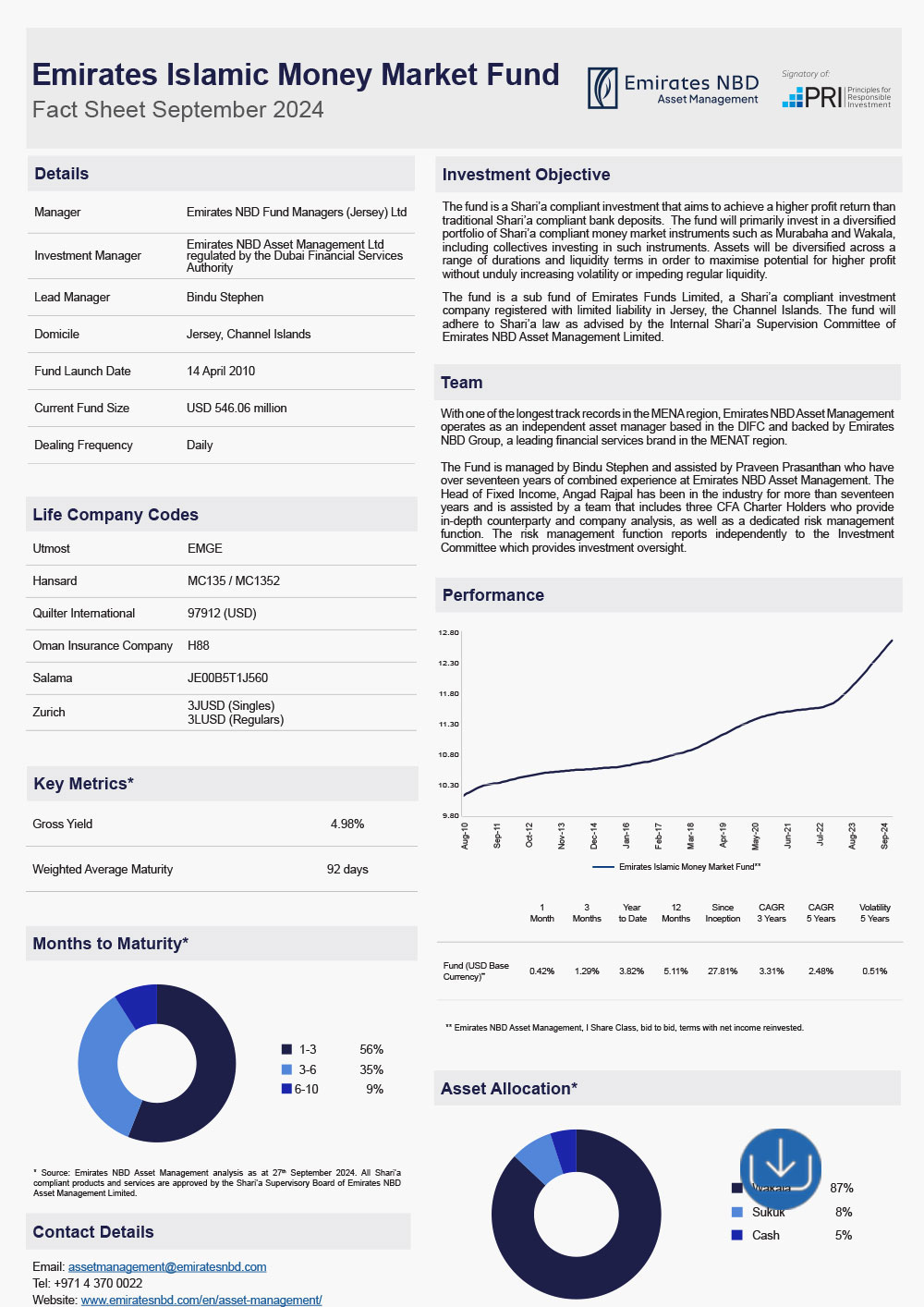

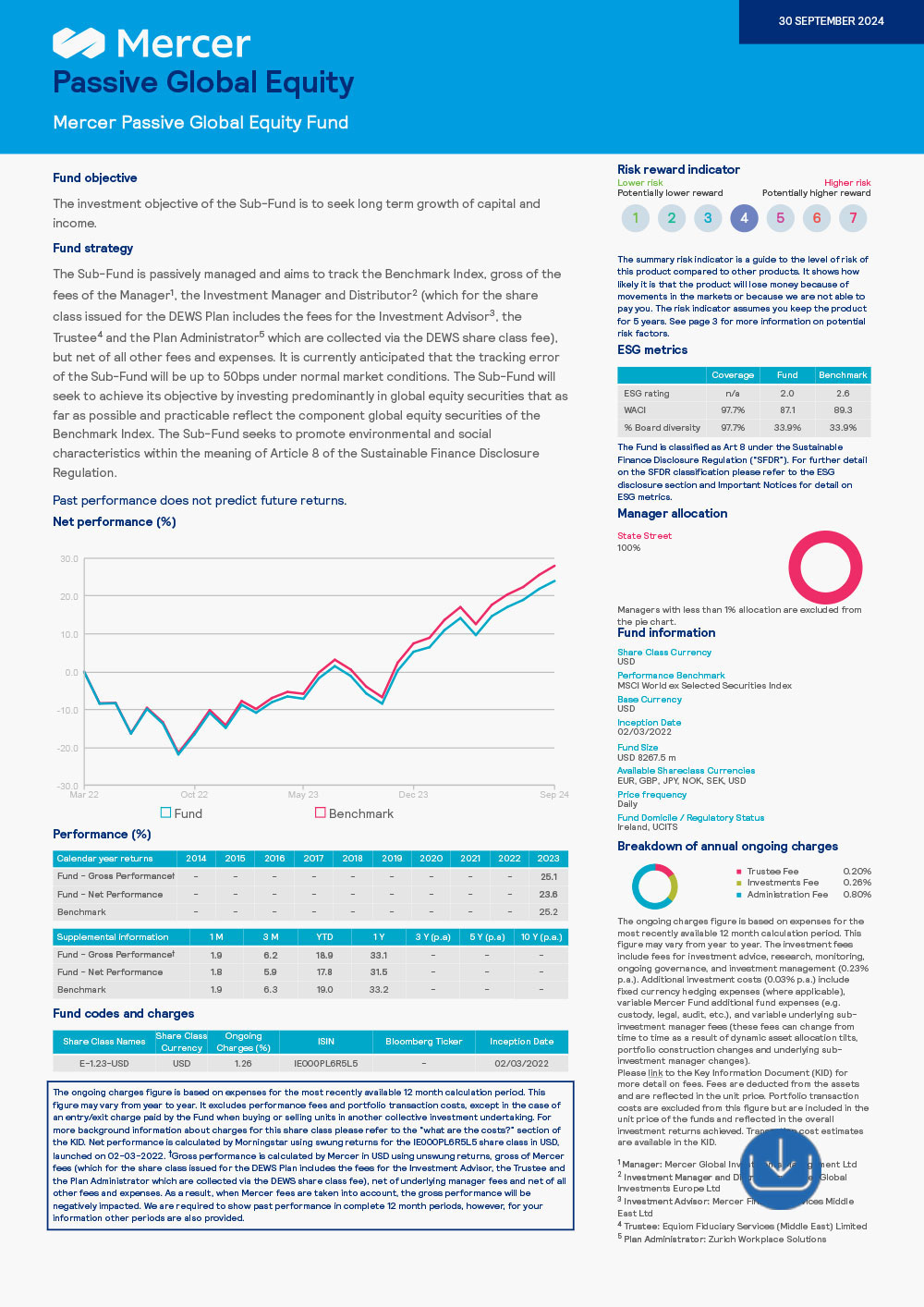

Your DEWS Plan offers diverse investment options to fit your risk tolerance and investment goals.

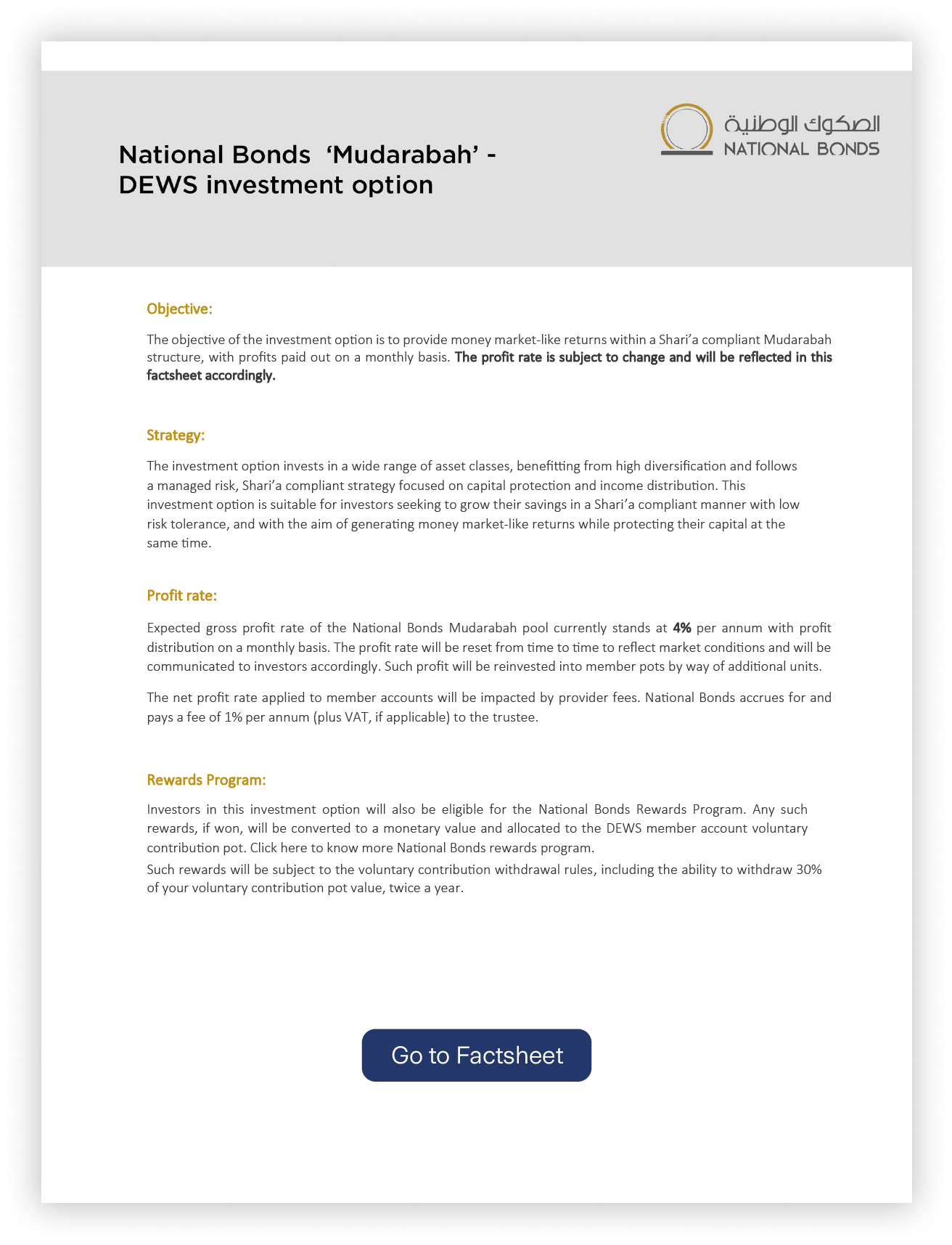

The investment options fall under two main categories — Conventional and Sharia-compliant options:

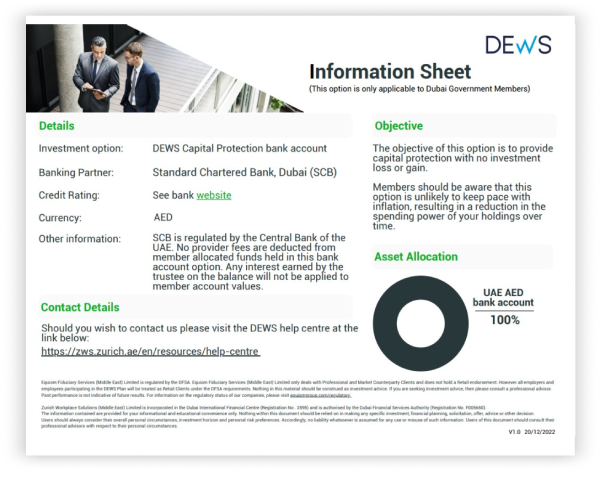

Other investment options

Read the Fund Centre User Guide below and access the Fund Centre for more information.

Read the Fund Centre User Guide below and access the Fund Centre for more information.

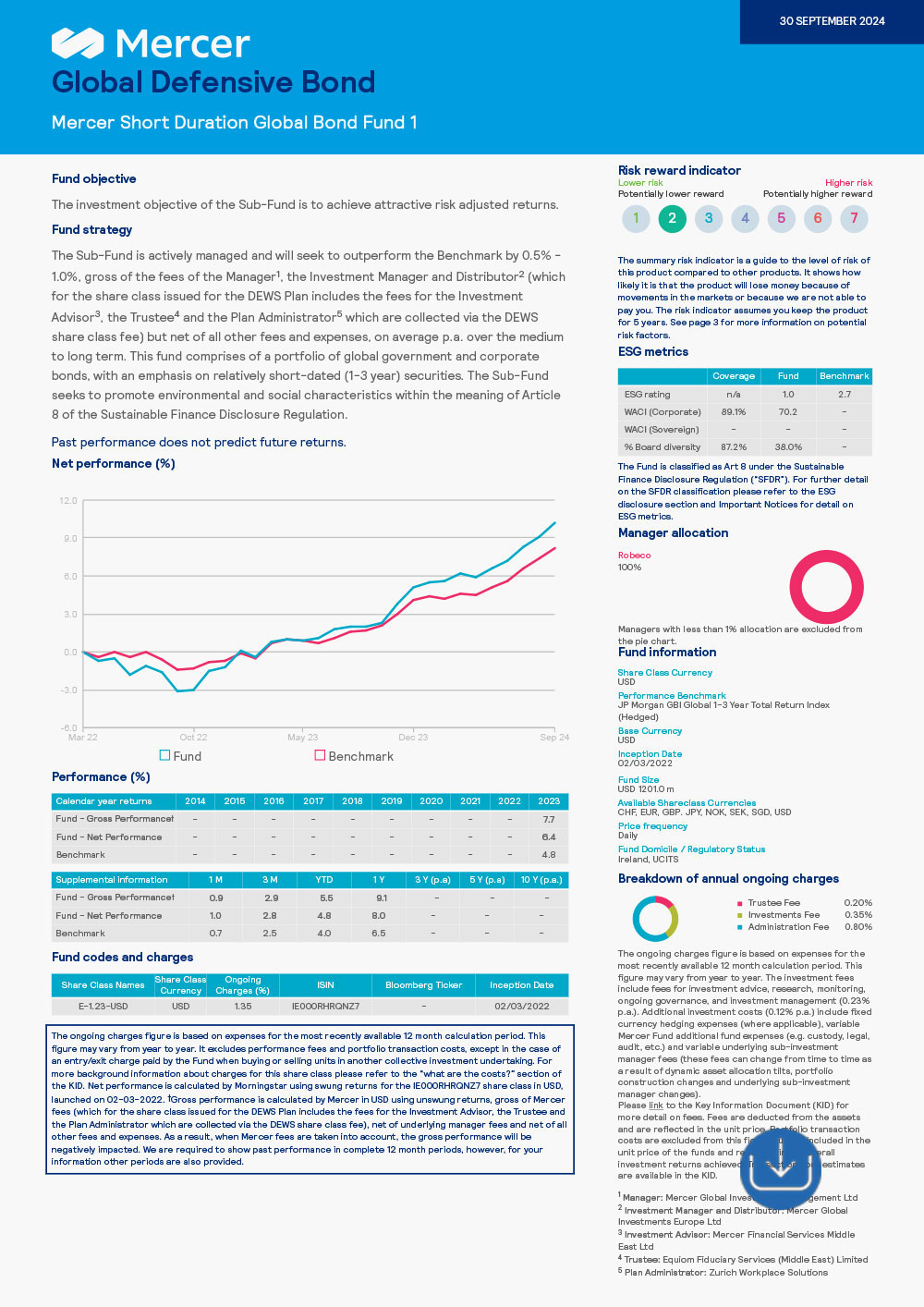

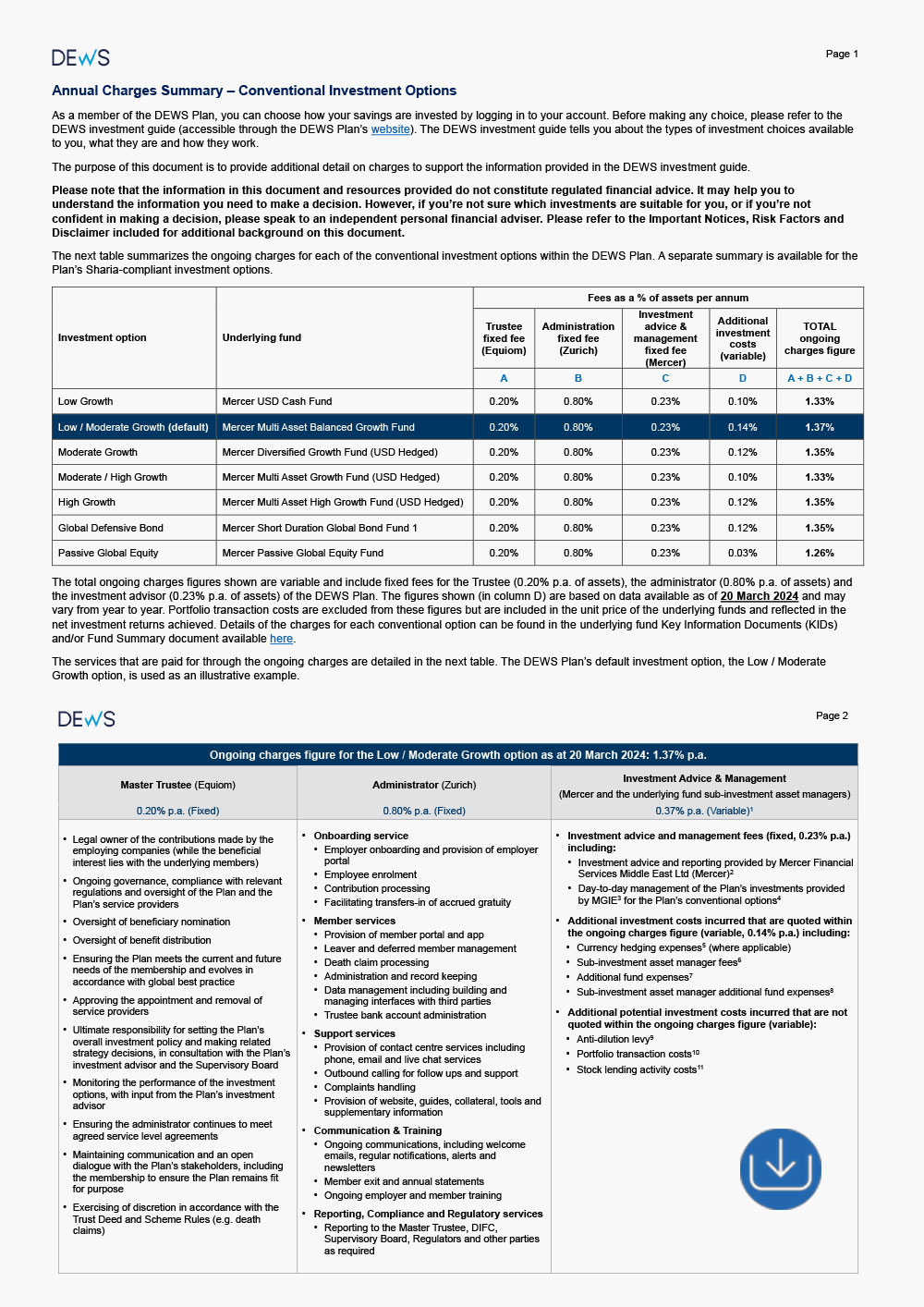

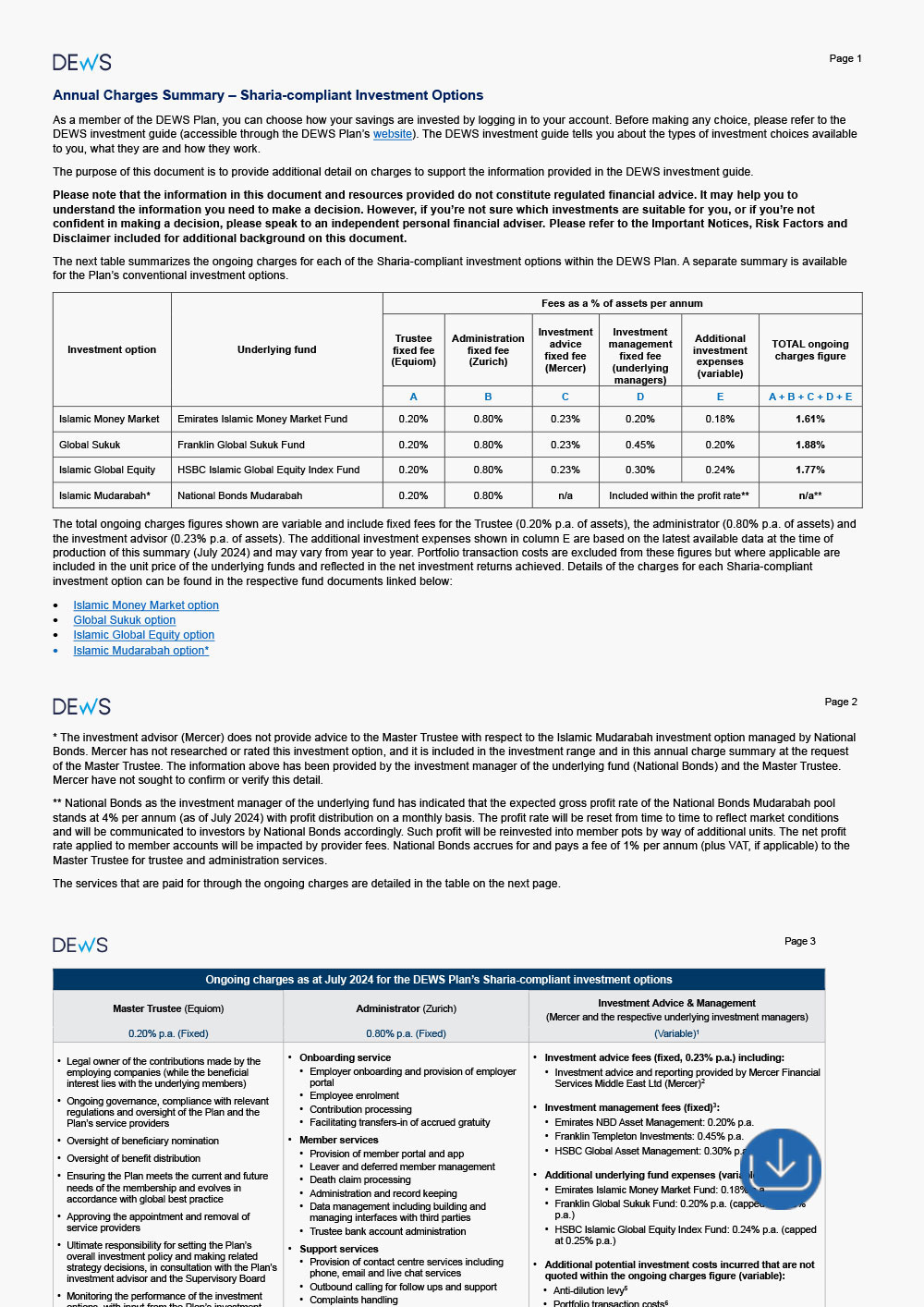

What are the DEWS fees?

When evaluating your total DEWS fees, it is important to note that the Plan has a strong governance structure with separation of duties between the Trustee, Investment and Administrator firms, overseen by a Supervisory Board. Such a structure ensures that employees’ and employers’ best interests, transparency and security are at the forefront of all decisions made.

We have a transparent fee structure. You can find details in the respective annual charge summary documents here.

Your DEWS guides

Useful documents

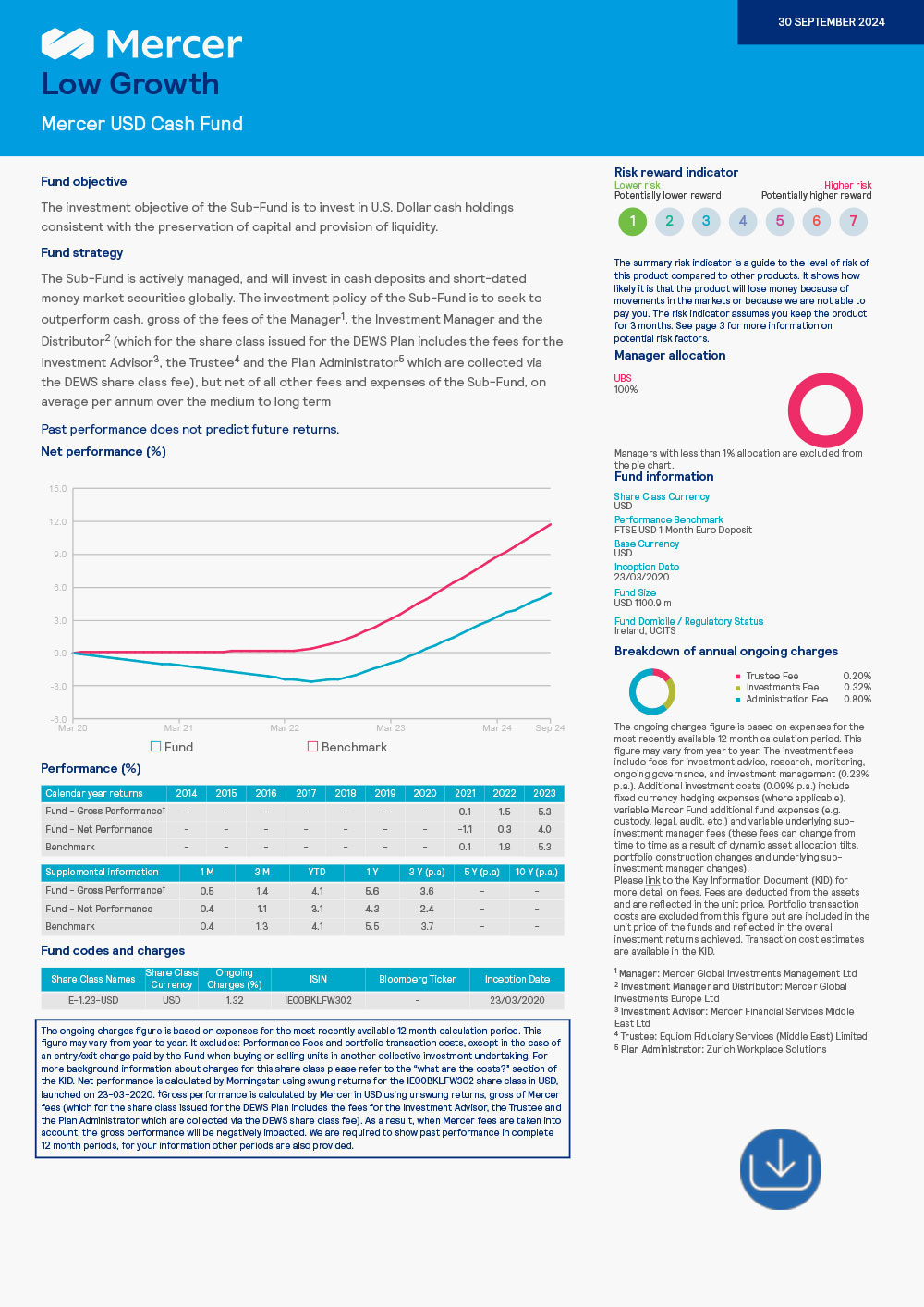

Find all the investment factsheets listed below:

*None of the current investment options available in the DEWS Plan are subject to any form of regulation or approval by the Dubai Financial Services Authority (DFSA). The DFSA have not approved any associated factsheets or any other associated documents nor taken any steps to verify the information set out in any factsheet and has no responsibility for it. Members should conduct their own due diligence on the investment options. If you do not understand the information available through this website or require advice, you should consult an authorized personal financial adviser.

**Please note that the DEWS Plans investment advisor, Mercer, does not provide investment advice to the Master Trustee on the Islamic Mudarabah investment option managed by National Bonds. Mercer has not researched or rated this investment option, and it is included in the investment range at the request of the Master Trustee. The information related to this Islamic Mudarabah option has been provided by National Bonds and the Master Trustee. Mercer has not sought to confirm or verify this detail.

Conventional

options

Conventional

options