DEWS in a nutshell

Legal requirement

DIFC companies have a legal requirement to register into a qualified plan like DEWS, enrol their employees and pay in end of service benefits to be compliant with DIFC Employment Law*.

*with some exceptions (See FAQ’s).

For all industries and sizes

DEWS is for any DIFC registered company with active employees, from small coffee carts to large multinational banks. All sizes and industries are eligible.

International standards

The plan is the first of its kind in the region and fully aligned with international standards. With DEWS companies can fully meet their end of service liabilities in each payroll cycle.

- A 5-minute digital, paperless, company enrolment experience.

- Access to a world class, cost-effective, professionally managed plan implemented by the DIFC and aligned with global best practice.

- The ability to tailor plan options to enhance your benefits package.

- A regulated way for your employees to save money and earn returns which may help to attract and retain the best people.

- Certainty that if you pay the statutory minimum contributions, you have fully met your liability in that payroll cycle.

- Greater cash flow certainty with end of service payments spread regularly and manageably over an employee’s tenure.

Click to jump to the section you’d like to read

Getting started | Employees | Contributions | Payments | Stand out | Changes | Leaving service | Learning academy | Providers | Documents

1. Nominate your administrator

Choose who will complete the DEWS enrolment steps that follow, this is typically someone from HR, Finance or Management.

2. Log into your DIFC Client Portal

In the ‘Company Services’ area, ‘Designate an authorised signatory for DEWS’. This person will sign the DEWS legal Deed.

3. Enrol for DEWS

The enrol button is below, simply click to get started. Your administrator will need to provide their contact info and submit your company application. Your authorised signatory will receive an email link to electronically sign the DEWS legal Deed.

4. Set-up tasks

Once your application is submitted, your company is registered for DEWS! Then you just need to tell us who owns your DIFC company, your company bank account details and add any other colleagues who need access in our ‘Users’ area.

…and you’re ready to go.

Who

All employees who are subject to a DIFC contract of employment or DIFC visa and who are receiving a basic salary,

* with some exemptions (see FAQ’s)

When

You should enrol employees after they have successfully completed their probation period, or immediately upon hire if no probation period applies.

5.83%

for employees with less than 5 years’ service.

8.33%

for employees with 5 years’ service or more.

+X%

You can choose to contribute more than this to enhance your benefits package.

Don’t forget

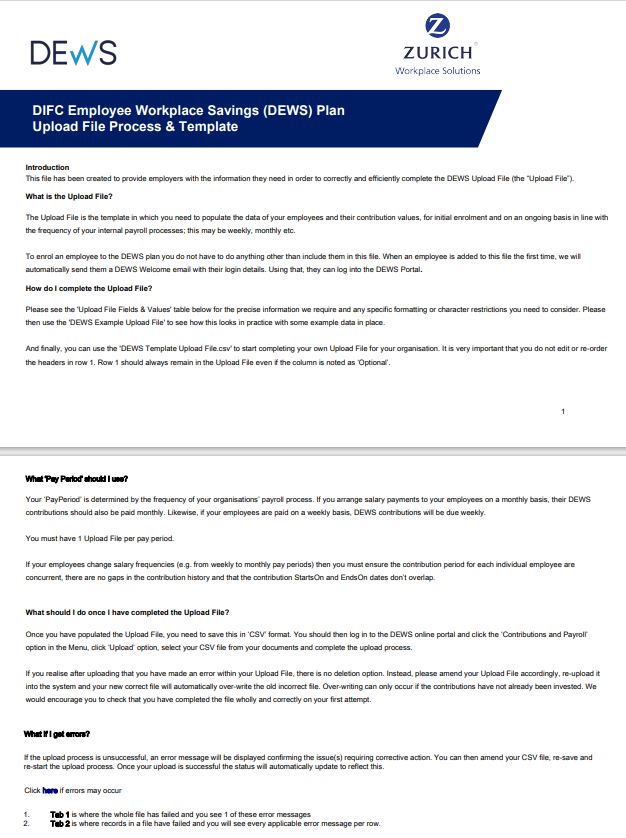

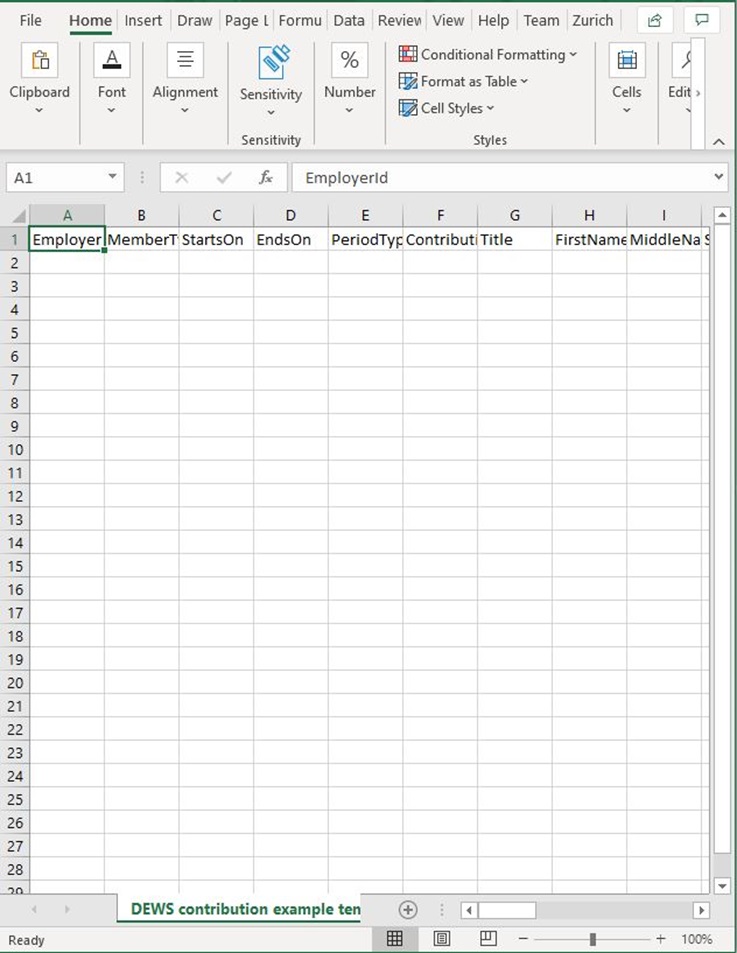

These contributions are payable each payroll cycle. If an employee has been on probation and is successful, you’ll need to pay a lump sum for all the months they’ve worked so far when you first enrol them. Add all these months together and include this on your first upload file. In future, you will pay one month at a time.

A unique account for you

Paying your contributions is easy. You can find your unique bank details for payment in your DEWS online portal on the upload page.

You then just need to instruct the payment with your bank. We don’t accept cash, cheques, or direct debits. We’ll never send bank details by email.

Multiple currency options

Contributions are always calculated in USD, but when it comes to payments you have currency flexibility. You can either pay us in USD or you can pay us in AED and we’ll convert the money when we receive it at our fixed rate of USD 1 = AED 3.6735.

To make sure we can allocate the full amount to each of your employees, your company must cover any bank transfer charges.

Set a monthly reminder

Contributions must be uploaded, and payment must be made before the 21st of the month following the payroll cycle. This means we should receive your money for August’s contributions before 21st September.

We’ll send email reminders along the way to help you.

Financial control

With your support your employees can choose to make additional voluntary contributions to DEWS through salary deduction. This is a great way to encourage employees to make the most of DEWS and to take full control of their financial future.

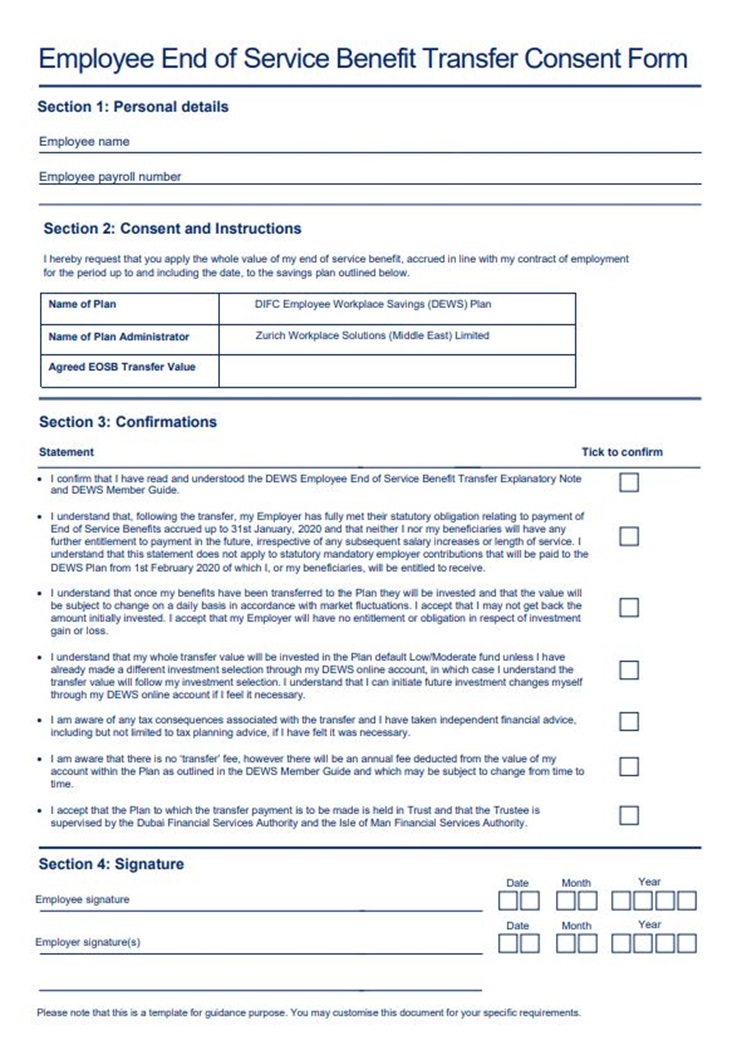

Consolidation

By mutual agreement, accrued gratuity held by the employer for the employee relating to service pre-1st February 2020 can be transferred into the employee’s DEWS account. This allows employees to consolidate, view and manage all their end of service benefits in one place.

Reassurance

Set up a DEWS employer account and transfer in your accumulated accrued gratuity for service pre-1st February 2020; topping up or withdrawing when required. Assure employees their historic monies are funded, professionally managed in DEWS and on hand when needed for payout in the future.

You can find supporting resources for each of these options in our Documents area.

If basic salary changes, what you do depends on an employee’s length of service:

For employees in service before 1st February 2020

- Adjust your accrual for their historic accrued gratuity that your company is liable to pay upon termination (if you've transferred this into DEWS with your employee's consent you can ignore this step).

- Adjust the monthly DEWS contribution from the salary change payroll cycle onwards, there’s no need to look backwards.

For employees in service from 1st February 2020 onwards

- Adjust the monthly DEWS contribution from the salary change payroll cycle onwards, there’s no need to look backwards.

When an employee reaches their 5-year service anniversary, their DEWS contribution percentage increases to 8.33% (as a minimum).

If an employee reaches their anniversary mid-month, their contribution is pro-rata’d with the proportion of the month less than 5 years calculated at 5.83% and the proportion of the month greater than 5 years calculated at 8.33%.

Divide the monthly basic salary by the number of days in the month for pro-rata calculation purposes.

Employee personal details can be updated at any time through the monthly upload file; the new information you provide will replace the old information we hold on our system.

If you need to change an employee’s personal details in between your monthly uploads you can do this using our simplified upload file which you will find in our Documents area.

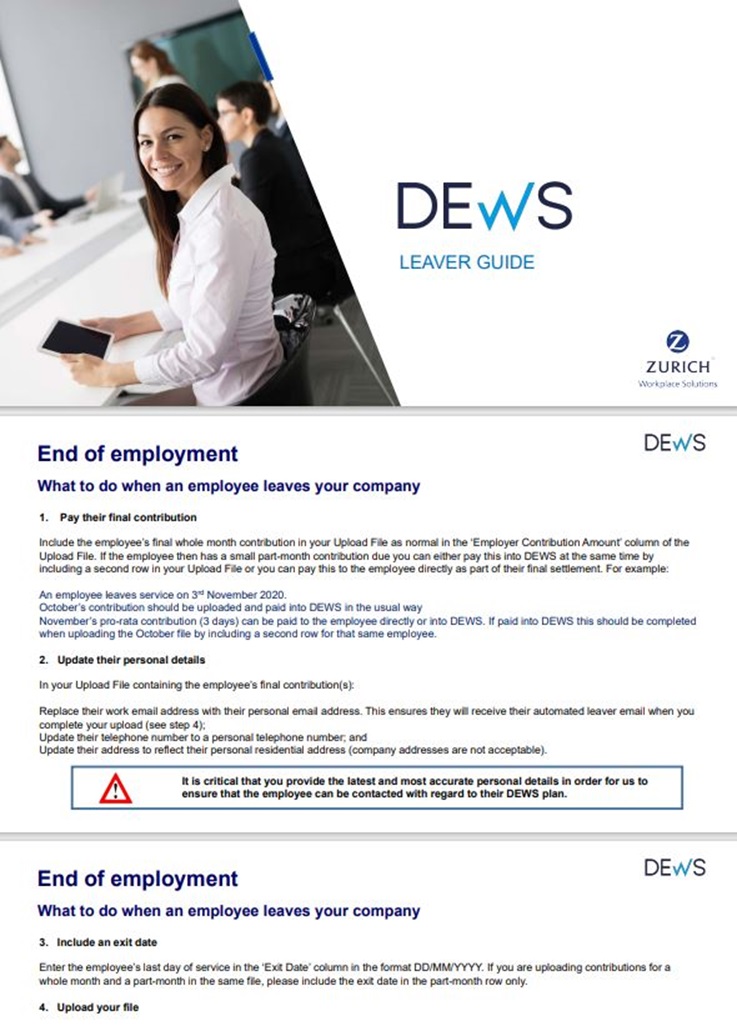

An employee leaves

You’ll let us know through your monthly upload file by telling us their last working day, final contribution and personal email address. We’ll then contact the employee to let them know their options and help them with their withdrawal if they don’t wish to stay invested.

An employee is seconded to another group company

If the employee remains eligible for DEWS contractually and legally, there should be no change and you should continue to pay contributions as normal.

Loss of life occurs

We’re here to support you and your colleagues. Contact us by email and we’ll liaise with the Trustee to begin the beneficiary claim process.

An employee is re-hired

You’ll enrol the employee into your plan in the normal way and a new account will be created for them. You’ll need to let us know that you’re doing this in advance as we might need to update their old account to allow their new one to be created.

Our FAQ covers a few more ‘what if…’ questions.

Employers - all the guides, templates and documents you need to administer your plan

If you would like further information or support, visit our FAQ’s & Documents page or use the Help Centre.